Awareness seems to be the most uncommon thing in Goa. BSNL has been offering its telephone subscribers in Goa with an added benefit of a personal accident insurance cover for a long time. However lack of awareness seems to be the reason why there has not been even a single insurance claim in Goa made to the BSNL in this regard.

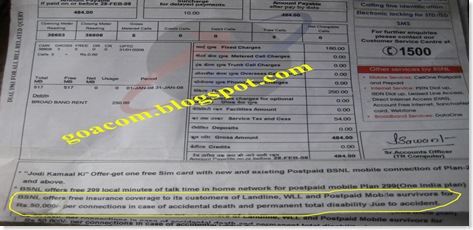

The information on the insurance cover is clearly mentioned both on the front of the telephone bill as well as the back. On the front side of the bill, the information is given just below the final bill total and reads as follows

" BSNL offers free insurance coverage to its customers of landline, WLL and Postpaid mobile survivors for Rs 50,000/- per connections in case of accidental death and permanent total disability due to accident" whereas the information is also provided on the back portion of the bill which reads as below

" BSNL offers free life insurance coverage to its customers of landline, WLL and Postpaid Mobile survivors for Rs 50,000/- per connections in case of accidental death and permanent disability due to accident. Contact M/s Bajaj Allianz toll free No 1800-225858 ( from BSNL/MTNL) 1800-1025858 ( From Bharti Mobile/ landline)

BSNL has an estimated 1,65,000 landline connections in Goa while the WLL connections account for over 8,000 subscribers and the postpaid cell phone connections in the state of Goa have totalled to around 22,000 users. However the department is yet to receive even a single case of accident insurance claim which is shockingly surprising.

As detailed in the information in the bill a subscriber/ survivor can claim an insurance cover of over Rs 50,000 in cases of accidental death and permanent total disability due to an accident. The BSNL has tied up with a private insurance player Bajaj Allianz for the service, and they will depute a surveyor to verify the authenticity of the claims made by the survivors.

The procedure is indeed very simple.All that one has to do is to dial up the toll free number mentioned on the bill (reproduced above ) and the insurance company is expected to follow the case from there on. The insurance company clarifies with BSNL the bonafides of the BSNL subscription of the claimant and since no such clarification has been sought from BSNL so far, the company has confirmed that no one has availed of the benefit till date.

According to the insurance coverage scheme offered by Bajaj allianz through BSNL, the permanent total disability is deemed to mean " loss of sight in both eyes, physical separation of/or loss of ability to use both hands or both feet, physical separation of/or loss of ability to use one's hand and one's foot and loss of sight of one eye.

One hopes that Goans will take advantage of the benefit in future and reduce their financial burdens rather than allow their claim to lapse thereby benefiting the insurance company

No comments:

Post a Comment